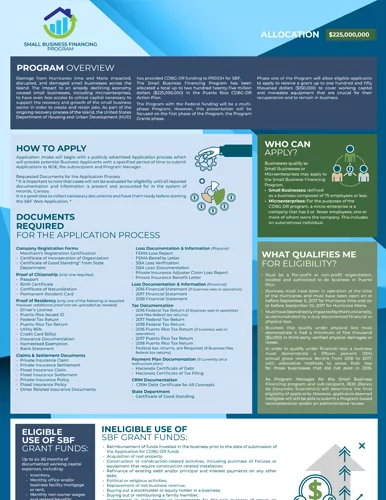

Allocation: $325,000,000

This program will provide eligible small businesses with Recovery Grants to assist with storm recovery and business expansion of businesses damaged physically or economically by Hurricanes Irma and/or Maria and new businesses that began as a result of damage caused by the Hurricanes to a prior business.

Program closed to new applications.

SMALL BUSINESS FINANCING PROGRAM

The Government of Puerto Rico, and the Department of Housing is proud to announce the launch of the Small Business Financing Program (SBF), financed with funds allocated by the Department of Housing and Urban Development (HUD).

SBF will provide a Recovery Grants phase (grants awards of up to $150,000) for working capital and moveable equipment for small businesses and microenterprises that suffered physical and/or financial losses due to the Hurricanes. Start-ups created after the Hurricanes are also eligible if they can show their creation was the result of a closure of a previous business of same owner(s), after damages caused by the Hurricanes. The Recovery Grants will assist economic recovery across the Island by creating new jobs, retaining current employees, and attending the urgent need for assistance that many small businesses in Puerto Rico have as a result of damages caused by the storms.

GUIDELINES

INFORMATIVE MATERIAL

VIDEOS

TRANSPARENCY PORTAL

Learn more about the progress of this program on the Transparency Portal

This portal is automatically updated on a daily basis.

FREQUENTLY QUESTIONS

- Through the Recovery Grants, small businesses that suffered damages from Hurricanes Irma and/or Maria may qualify for funding through grants of up to $150,000, to assist recovery and growth.

- Start-ups created after the Hurricanes, which can show storm damage to a prior business of the same owner(s) may also qualify (the new business must have begun operations prior to the launch of this program – March 25, 2020).

- Meeting one of the national objectives of CDBG-DR funds, the Department of Housing has set a minimum target for spending thirty percent of SBF funding on projects that result in a benefit for people with MMI or that serve Low- to Moderate-Income areas.

- Small businesses that suffered damages from earthquakes or COVID-19 may participate, so long as it can prove damage caused by Hurricanes Irma and/or María.

- Small businesses and micro-enterprises on the island are eligible to apply for assistance. This includes sole proprietorships. Applicants must show evidence of hurricane-related damage or disruption and an unmet need for assistance.

- The Economic Development Bank for Puerto Rico (BDE by its acronym in Spanish) will serve as General Manager of the SBF Program under a sub-recipient agreement. The BDE will be responsible for managing all major aspects of the Program, Including;

- Providing Grant servicing

- Conduct admission and eligibility reviews

- Request missing Information from Applicants

- Perform award calculation and draw schedules

- Provide applicant and customer support

- Maintain accurate records and documentation

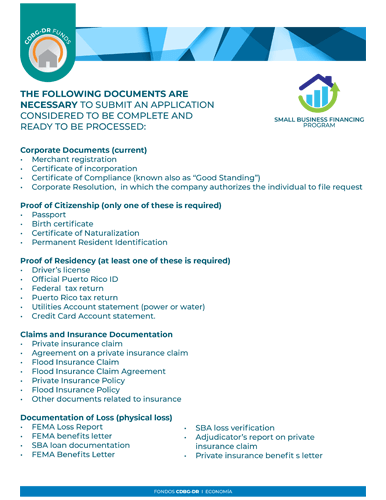

For Eligibility Requirements and other program information, please access the Program Guides published on the website here.

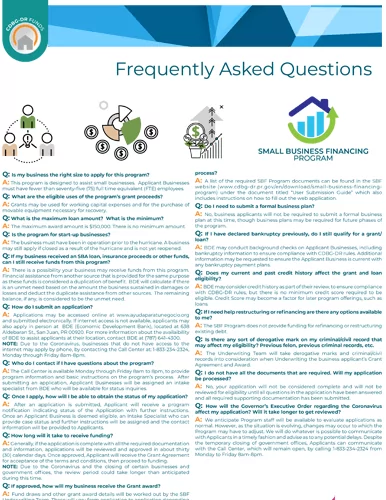

- The application can be completed online, in the link provide above on this page; you may click here to apply. For more information you may contact the PRDOH CDBG-DR Call Center at 1-833-234-2324 or send an email to EcoRecCDBG@vivienda.pr.gov. The Call Center will be able to help those who are unable to apply online, to apply by phone.

- Business owners and owners who are considered or who meet the requirements of small businesses or micro-enterprises may apply to the Small Business Financing Program if they show financial or physical damage caused by Hurricanes Maria or Irma to their business.

- Small Businesses: defined as a business composed of 75 employees or less. Includes microenterprises and sole proprietors.

- See Program Guidelines V5, found on this website published on December 30, 2021 for a full list of eligible business types and more detail on program requirements.

- This program was launched in March 25, 2020. At this time no deadline for accepting applications has been determined, SBF will continue accepting applications for the time being, subject to availability of its assigned funds. BDE reviews complete SBF applications on a first come first serve basis.

- The program will support the recovery of small and micro-enterprises through grants of up to $150,000 to cover working capital and moveable equipment or furniture.

- Eligible use of funds includes Up to six (6) months of documented working capital expenses, including: inventory, utilities, non-owner salaries, and business rent/mortgage payments.

- Working capital calculations are based on monthly averages calculated from the Applicant’s expenses as listed on its business tax return, and/or mortgage statements.

- Includes purchase of moveable equipment that is not affixed to real property and that assist with an unmet need for the recovery of the business.

- Three quotes for each equipment Applicant intends to buy with the funds, will be requested from Applicant Businesses.

- Awarded businesses will have to comply with the closeout process to avoid recapturing of the funds awarded. This includes providing proof that the funds were utilized for the approved intended purposes.

- Eligible use of funds includes Up to six (6) months of documented working capital expenses, including: inventory, utilities, non-owner salaries, and business rent/mortgage payments.